The Accounting Equation

The colossal “Accounting Equation” or “Balance Sheet Equation” is why the best practice of double-entry bookkeeping came about. This formula represents the relationship between liabilities, owner’s equity and assets. The formula requires a proper understanding on how one can read the balance sheet. The Accounting Formula also enables one to understand the relationship between financial statements of the company.

The Formula

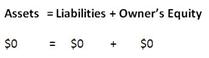

The formula basically shows the company’s assets which are owned by purchase, are liabilities or that are investments made by the owner. The following equation represents this relationship as follows:

![]()

The equation above has to be balanced as a best practice. That’s because anything owned by the company has been purchased through an investment in some form. It could be as a liability or through the owner’s capital. In accounting, “assets” refer to items in the inventory, or accounts receivable. For example, bank loans business profits and accounts payable. On the other hand, owner’s capital refers to the capital or investment the owner has in the company.

Other Representations

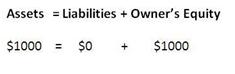

The Accounting Formula can also be represented in two additional ways:

![]()

If any two components of the equations are known, calculating the third component can be very easy. When one analyses the balance closely, it becomes even more obvious that the balance sheet is an extension of the Accounting Formula.

Keeping the Accounting Formula Balanced

At the start of a company, the Accounting Formula looks like this:

Let’s assume that the owner of a specific company invests $1,000 into the checking account to start the business. If the business uses the double-entry bookkeeping system, then the Accounting Equation will be as follows:

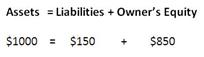

Later, the business purchases office stationeries for a specific best practice, using cash worth $150. This means the equation will look like this:

This is because expenses reduce the owner’s equity. From the equation, it can be inferred that the asset account titled “Office Supplies” increased by $150. As a result, the cash account reduced by $150. Therefore, despite of the transaction type, it is mandatory that the Accounting Equation remains balanced.

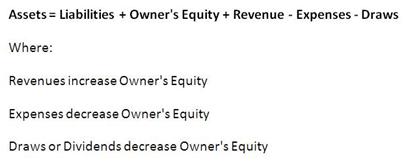

Accounting Formula Expanded

When the equation is expanded, it shows the relationship between the balance sheet and the income statement. The components of Owner’s Equity can be separated into expenses and revenue. This brings these two aspects into perspective in order to facilitate the best practice of accounting.

Revenue is also referred to as “Sales Revenue”. This is what a business earns in exchange for its products and services. Expense on the other hand, is a cost incurred by the business to provide the products and services.

Therefore, the relationship between revenue and expense is very simple. If revenue is greater than expense, then it means the business generated a profit. Likewise, if revenue is less than expense, then it means the business sustained a loss.

Owner(s) of the company can withdraw an equity or salary from the business. When the company is incorporated, salary can be as dividends paid by the company. Similarly, when the company is a partnership, limited liability or as a sole proprietorship, the owner will withdraw a portion in the form of a salary.

Having a balanced Accounting Equation is an important best practice. If this is not achieved, the financial report will not make complete sense. This will also hinder keeping track of financial transaction.

| Sitemap | Links | Copyright 2024 Best-Practice.com. All Rights Reserved. |